Protect your best clients from financial disaster.

By introducing them to a qualified financial advisor and allied professional in Sterling Rempel.

You’ll know when to refer clients to Sterling.

Clients are not managing their money optimally.

Clients face an unexpectedly large tax bill.

Clients suffer a reduction in the value of their life’s work.

You know you can trust Sterling with your clients.

When clients ask questions about financial topics outside your scope of work, who can you turn to? As a trusted financial advisor with advanced designations in a number of wealth management disciplines, Sterling has answers.

Why you should refer clients to Sterling:

Clients are not sure if they are managing their money optimally.

They don’t know if they can retire and meet their continued cash flow needs. They are not taking full advantage of tax-preferred investments. And even if they had all the money to support their retirement needs, they do not know how to access it efficiently. They may have various financial products, but don’t know if they need them or not, or if they face unknown unknowns.

A qualified financial advisor can help your client move from where they are now to where they want to go.

Clients are facing an unexpectedly large tax bill as a result of their success.

They’ve been successful, and that success comes with a price: an increasing tax bill on the growing value of their company, real estate, and investment accounts. They are unaware of how to preserve more of the proceeds from liquidity events for themselves and their family. As a result, they miss opportunities and pay more tax than necessary.

A qualified financial advisor can mitigate or eliminate taxes.

Clients suffer a reduction in the value of their life’s work when failing to plan.

Everyone wants to maximize the value of their business for their own benefit, for their family legacy, and inter-generationally. In the end, they want to minimize what goes to the government. By failing to plan, more taxes are paid than necessary.

A qualified financial advisor empowers your client to give to family and charitable organizations that are aligned with their values.

What can happen if you don’t introduce your clients to Sterling?

Your clients won’t be sure that they are going to be okay – no matter what – if they don’t engage a qualified financial advisor.

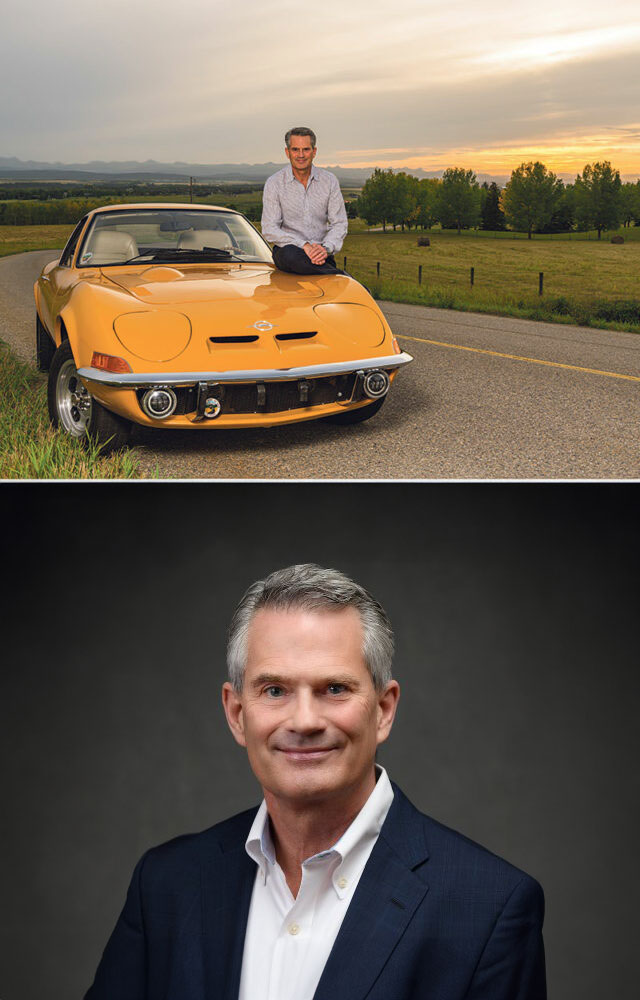

Get to know Sterling. He’s a highly qualified, award-winning financial advisor.

Sterling Rempel, CFP®, CIM, CLU, TEP, MFA-P

Sterling Rempel is the founder and principal advisor at Future Values Estate & Financial Planning, an independent financial planning firm. He is a Certified Financial Planning professional and holds the distinction “FP Canada Fellow™.” That is an honour awarded to less than 70 of the 17,000 CFP® professionals in Canada. He has been a Top 3 Finalist, twice, in the PlanPlus Canada Financial Planning Awards,

He is a wealth and estate planning specialist with a focus on creative uses of tax-preferred insurance products. He has a special interest in responsible investments and in charitable planned giving, having served on the boards of numerous not-for-profit organizations.

A 30+ year veteran in the financial services industry, Sterling founded Future Values Estate & Financial Planning in 1999. He began his career in 1985 and worked with two national insurance firms in management roles.

Sterling enjoys outdoor activities: sailing, scuba diving, snowboarding, and sports cars. In his spare time, he and his wife are restoring a vintage Airstream trailer. They are proud parents of four adult children and four grandchildren.

Professional designations held:

- CFP – Certified Financial Planner

- CIM – Chartered Investment Manager

- CLU – Chartered Life Underwriter

- TEP – Trust and Estate Practitioner

- MFA-P – Master Financial Advisor, Philanthropy

- CH.F.C. – Chartered Financial Consultant

- CKC – Certified Kingdom Advisor

- RIAC – Responsible Investment Advisor Certification

- EPC – Elder Planning Counselor

- RHU – Registered Health Underwriter

- FLMI – Fellow, Life Management Institute, with Distinction

- HIA – Health Insurance Associate

- FP Canada Fellow™

Professional memberships:

- Advocis, The Financial Advisors Association of Canada

- Canadian Initiative for Elder Planning Studies

- Canadian Institute of Financial Planners

- Conference for Advanced Life Underwriting

- Estate Planning Council, Calgary

- FP Canada

- Responsible Investment Association

- Society of Trust & Estate Practitioners

A path to financial management

1

Introduce Financial Advisement

Set up the introduction, assess fit, identify areas that are sub-optimal.

2

Coordinate and Share Information

Build on the good work you’ve already implemented, coming from a different perspective with the same goal.

3

Clients are Protected from Financial Disaster

Your clients develop greater financial independence, increased certainty, and your relationship with them is enhanced.

Working with Sterling, your clients will gain peace of mind knowing that they are going to be okay no matter what.

Sterling is an established, award-winning financial advisor uniquely equipped to assist your clients with a strategic, holistic approach to values-based wealth management. He holds an FP Canada “Fellow” Distinction, as well as advanced designations in a number of wealth management disciplines.

FAQs

Can I trust Sterling?

Through his firm Future Values Estate and Financial Planning (est 1999), Sterling and his team offer clients a wealth of knowledge on financial, retirement, estate, charitable gift planning, insurance, and investment options in support of established accounting practices. We acknowledge that we have a independent fiduciary responsibility favouring the client, and truths and facts as we have a duty of care to the insurance company as per our code of ethics.

Can I see your code of ethics?

Principle 1: Duty of Loyalty to the Client

The Duty of Loyalty encompasses: The duty to act in the client’s interest by placing the client’s interests first. Placing the client’s interests first requires the Certificant place the client’s interests ahead of their own and all other interests; The obligation to disclose conflicts of interest and to mitigate conflicts in the client’s favour; and The duty to act with the care, skill and diligence of a prudent professional.

Principle 2: Integrity

A Certificant shall always act with integrity. Integrity means rigorous adherence to the moral rules and duties imposed by honesty and justice. Integrity requires the Certificant to observe both the letter and the spirit of the Code of Ethics.

Principle 3: Objectivity

A Certificant shall be objective when providing advice and/or services to clients. Objectivity requires intellectual honesty, impartiality and the exercise of sound judgment, regardless of the services delivered or the capacity in which a Certificant functions.

Principle 4: Competence

A Certificant shall develop and maintain the abilities, skills and knowledge necessary to competently provide advice and/or services to clients. Competence requires attaining and maintaining a high level of knowledge and skill, and applying that knowledge effectively in providing advice and/or services to clients

Principle 5: Fairness

A Certificant shall be fair and open in all professional relationships. Fairness requires providing clients with what they should reasonably expect from a professional relationship, and includes honesty and disclosure of all relevant facts, including conflicts of interest.

Principle 6: Confidentiality

A Certificant shall maintain confidentiality of all client information. Confidentiality requires that client information be secured, protected and maintained in a manner that allows access only to those who are authorized. A relationship of trust and confidence with the client can be built only on the understanding that personal and confidential information will be collected, used and disclosed only as authorized.

Principle 7: Diligence

A Certificant shall act diligently when providing advice and/or services to clients. Diligence is the degree of care and prudence expected from Certificants in the handling of their clients’ affairs. Diligence requires fulfilling professional commitments in a timely and thorough manner and taking due care in guiding, informing, planning, supervising, and delivering financial advice and/or services to clients.

Principle 8: Professionalism

A Certificant shall act in a manner reflecting positively upon the profession. Professionalism refers to conduct that inspires confidence and respect from clients and the community, and embodies all of the other principles within the Code of Ethics.